Allworth Chief Investment Officer Andy Stout specifically addresses four of the biggest questions we're finding most people are asking right now as market volatility continues.

#1: Will stocks keep dropping?

We understand that 2022’s market selloff is stressful and emotionally challenging. You might even feel at times that your financial goals are in jeopardy. But remember, we’ve overcome every other economic scare and market decline in history. While these things rarely pass overnight, with history as a guide, accept that it might just take some time to get through it.

But rest assured, it will pass.

As professional evaluators of the stock market, we’d like to point out a few facts about how it operates:

Fact 1: Positive years are far more common than down years.

How much more? Large-cap stocks (the S&P 500) have produced positive calendar year returns a whopping 80% of the time over the past five decades. True, while not every year can be a bull market, those numbers clearly show that disciplined investors who stay the course have benefited immensely by remaining invested in the market.

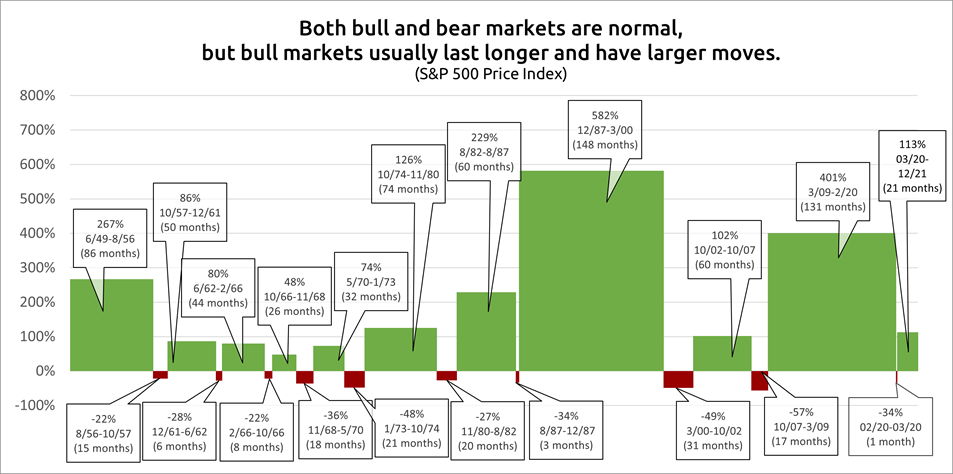

Fact 2: Markets are nothing if not cyclical.

Bear markets have historically been followed by ever-stronger bull markets, suggesting patient investors will fulfill their financial goals.

As of 12/31/21

As of 12/31/21

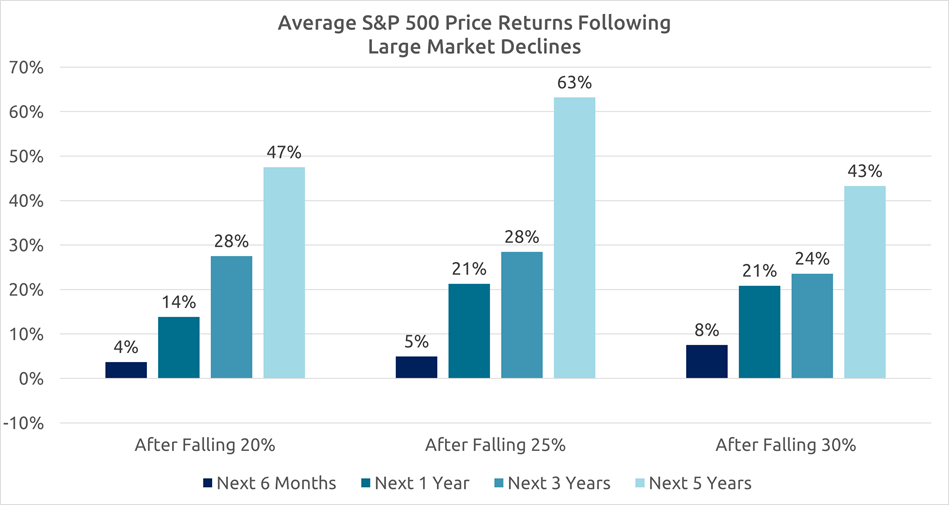

Fact 3: Selling after a significant market drop is almost always a bad decision.

As you can see from the chart below, the S&P 500 generated an average 14% return one-year after dropping by 20%.

Okay, the market tends to reverse most of its losses almost immediately after a bear year, but what happens over a five-year period following a 20% market drop?

The cumulative average return climbed to an impressive 47% increase over the next five years.

As of 12/31/21

As of 12/31/21

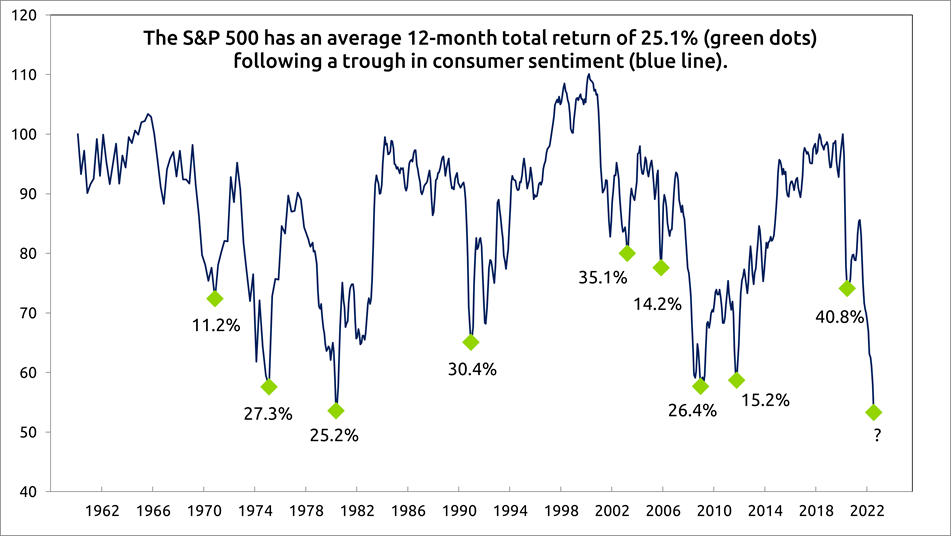

Fact 4: The market has produced some of its highest returns when people are the most worried.

Consumer sentiment is a key economic indicator that measures how optimistic consumers feel overall about their finances and the state of the economy. Consumer sentiment cratered to a multidecade low this year, as people are understandably concerned about things like inflation, the actions of the Federal Reserve, Ukraine/Russia, and the possibility of a recession.

As measured by the three-month average of the University of Michigan’s consumer sentiment survey, previous lows in consumer sentiment were followed by a 25% average 12-month forward return for the S&P 500.

As of 9/23/22

As of 9/23/22

That said, of course it’s impossible to know when markets will (or if they already have) hit bottom. But while we would not be surprised if market turbulence continued in the months ahead, we would be significantly more surprised if we look back five years from now and discover that the current market wasn’t actually an attractive entry point for long-term investors.

#2: Is a recession coming?

Our nation’s central bank, the Federal Reserve (Fed), has a dual mandate of stable inflation and full employment. Unfortunately, as virtually everyone knows, inflation is far from stable. As a result, when it met this week, the Fed increased interest rates by 0.75% for the third straight time. The fed funds rate is now in a range of 3.0% - 3.25%.

Further, the Fed presented a much more hawkish view than it has in nearly 40 years. The monetary policy committee indicated it would hike interest rates by a total of 1.25% in its final two meetings this year. Importantly, policymakers revised their rate of unemployment predictions higher for the coming years. In other words, it appears that the Fed is willing to risk hiking us into a recession to get inflation under control.

While the word “recession” can understandably send a chill down your spine, just remember that they aren’t at all rare. In fact, it may surprise you to know that there have been 17 recessions in the past 100 years. (While we won’t predict that a recession is coming, sometimes recessions are so mild that they aren’t even acknowledged as having occurred until they are already over.)

Presently, the risk of a recession is high, and one may occur in the not-too-distant future.

But while recessions can be scary, they also provide opportunities. Historically, markets hit bottom well before a recession ends, so if an investor is waiting for a recession to end before investing, they may have already missed out on significant gains.

#3: What's going on with bonds?

The fixed income market has experienced its own volatility, meaning investors haven’t enjoyed the usual safe-haven protection with bonds that they typically get during stock market declines. Increasing inflation and an aggressive Fed have caused interest rates to rise in 2022. Consequently, bond prices have fallen (interest rates and bond prices usually move in opposite directions).

At the beginning of 2022, the market expected only 0.75% in rate hikes, but it now looks like we could end up with hikes totaling 4.25%. So, with the market already pricing in future rate hikes, future bond performance partly depends on whether the Fed hikes more or less than expected.

On the bright side, bonds are a much more attractive investment option than they have been over the previous 10 years because of the higher income they now generate. Of course, market rates could move up (depending on what the Fed does and the economic growth outlook), but longer-term investors should benefit from the increased income.

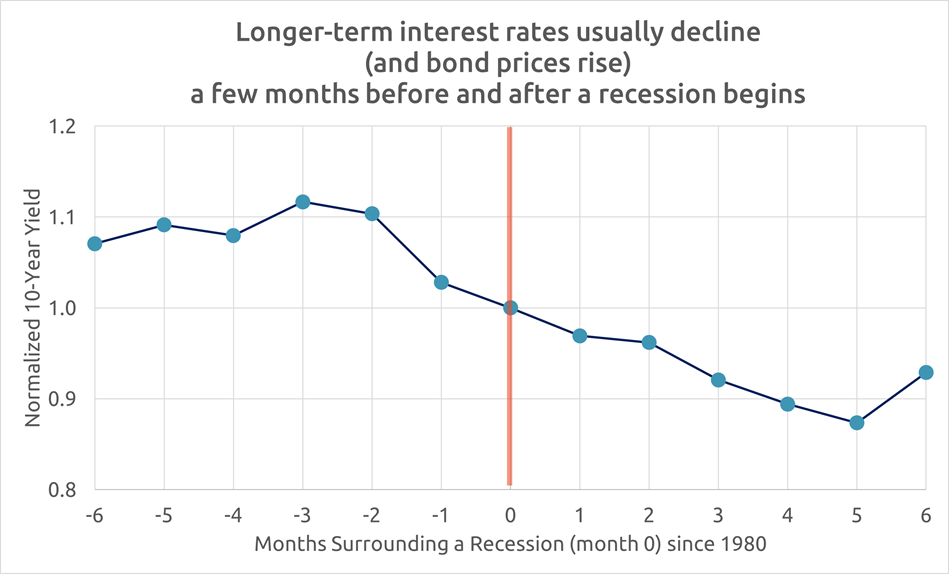

Like equities, bond markets run in cycles. Usually, longer-term interest rates tend to drop near the beginning of a recession as economic growth prospects deteriorate. This suggests that bonds will once again add value in the months ahead as they begin to perform as they historically have.

#4: What should I be doing right now?

Bear markets and recessions are terms no investor wants to hear. However, they are part of the cycle, and as previously discussed, they are far from uncommon. Part of investing is enduring volatility. After all, stocks and bonds have consistently gained in value over time, and investors who have remained patient have weathered the storms and reaped the benefits of recovery.

As we look ahead, investors should prepare for potential volatility. On the one hand, the Fed raising short-term interest rates, a slowing economy, and rising geopolitical risks (e.g., Russia’s invasion of Ukraine) could pressure stocks and bonds in the near term.

On the other hand, history suggests now could be a good time to invest if you have money on the sidelines and if you can withstand possible short-term turbulence to enjoy long-term gains. After all, stocks have already experienced a sizable selloff, consumer sentiment is at an extreme low, and bonds now generate an attractive yield.

We know that volatile times like these can take an emotional toll on you. We fully understand that it’s not always easy. Just remember, however, that if you’re a client of Allworth Financial, we constructed your financial plan with the knowledge and experience that market turbulence and economic slowdowns occur, so it’s critical to follow your individualized financial plan so you can navigate these uncertain times and meet your financial goals. As always, we're here to help.