Allworth Chief Investment Officer Andy Stout explores what the Delta variant means for the economy, as well as other financial risks, including tapering and taxes.

This past summer vacation with my family, the road was clear as we were driving down south. Then, seemingly out of nowhere, a long line of traffic ground us to a halt.

We’ve all experienced moments like that, and now the economy is as well.

An economic rough patch

When Covid cases were dropping as we headed into the summer, the economy was on pace to grow north of 7% on an annualized basis in the second half of this year. But, unfortunately, the Delta variant quickly changed that optimistic scenario.

The most recent monthly jobs report showed that the number of new jobs added in August was 235,000. Before Covid, that would’ve been a fantastic number. However, economists were expecting 733,000 new jobs.

Diving into the report’s details reveals that one primary reason for the miss was that zero jobs were added in the leisure and hospitality industry. Within that industry, restaurants lost 42,000 jobs and retailers lost an additional 29,000.

What stands out is that the lost jobs were concentrated in high-contact industries, suggesting that Covid was a driving force for the miss.

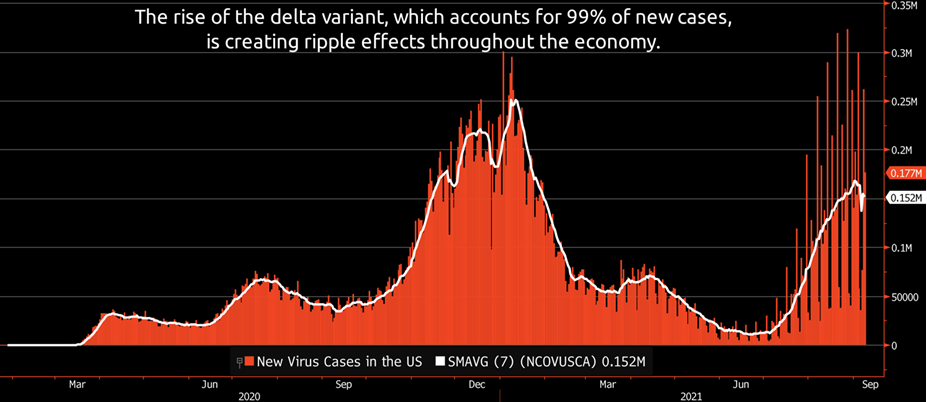

It isn’t surprising that Covid has impacted the economy, given the rapid rise in new cases. Just in the last month, there were seven days when the number of new daily cases eclipsed 250,000, with three days at or above 300,000.

Because daily data can be sporadic, we prefer to look at the seven-day average of new cases (the white line below). It helps show how much the Delta variant has penetrated our society, and it helps explain why there was a decline in jobs that would be considered high-contact.

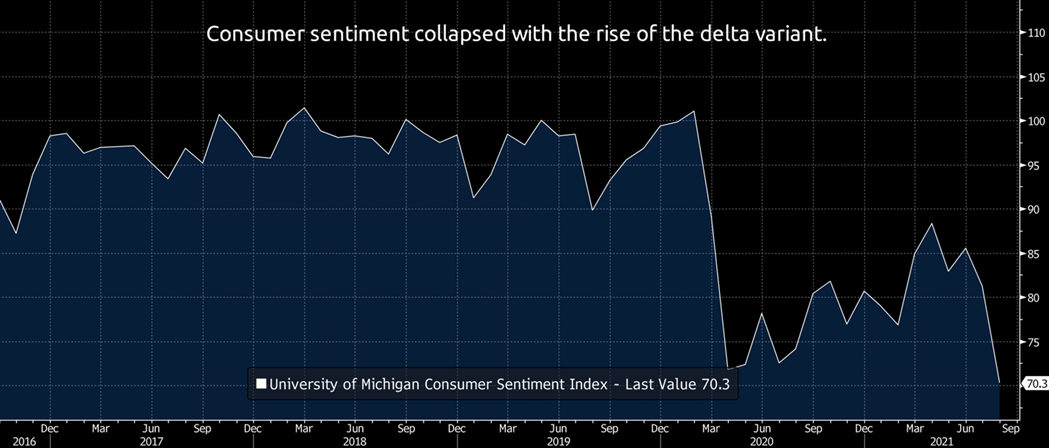

It’s not just the job data that is feeling the effects of Covid. Consumers are feeling it too. The consumer sentiment index fell to its lowest level since December 2011. The drop in sentiment is part of the reason that retail sales recently declined much more than expected.

A clearing is in sight

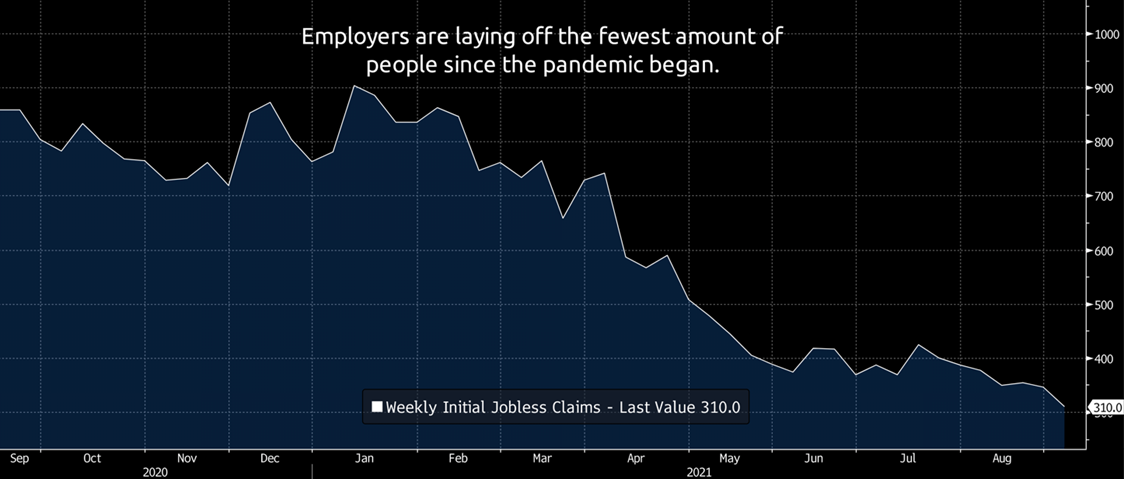

Other data suggest limited risks for the economy. For example, the number of people filing for first-time jobless benefits hit another pandemic low.

Part of the reason for the low number of layoffs is that employers are having difficulty finding workers, so they don’t want to lay off their employees. In addition to this, the number of job openings jumped to a new record high of 10.9 million. Interestingly, the number of job openings far exceeds the number of unemployed people. This discrepancy has occurred as people have stopped looking for work for various reasons, such as retirement or concerns related to the virus.

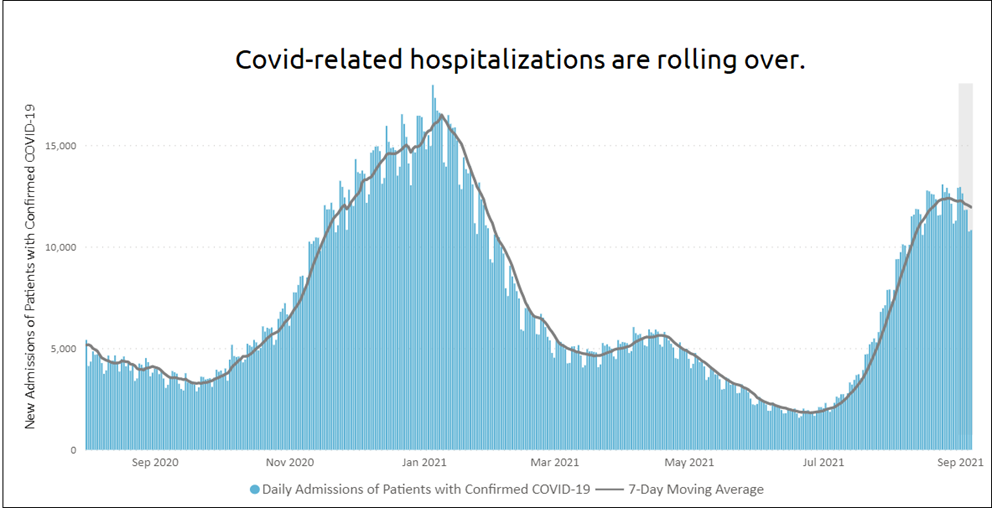

While it’s nearly impossible to predict how Covid will evolve, certain statistics provide glimmers of hope. First, data from the CDC shows the percent of positive Covid tests is rolling over. It’s dropped from 10.3% to 9.3% in the past couple of weeks. Second, the number of Covid-related hospitalizations appears to be topping out. This data could mean we are close to the peak of the Delta wave.

Back to my summer vacation mentioned earlier: we were stuck in traffic for quite some time. What is typically a 10-hour trip ended up being closer to 13 hours.

But, as it always does, eventually, anyway, traffic lightened up and we again got back on our way.

Fortunately, the data – as discussed above – suggest the economy will get back to cruising speed sooner (at least figuratively) than my family was able to. Many economists still expect the economy to grow about 5-6% in the second half of this year.

Risks to keep an eye on

There will still be many detours to navigate, such as inflation and increased tension with China. We’ve been regularly sharing our thoughts on these risks in these monthly evaluations.

Another threat we’ve discussed is "tapering," so let’s dive into this one again because we’ve recently learned some new information.

Tapering

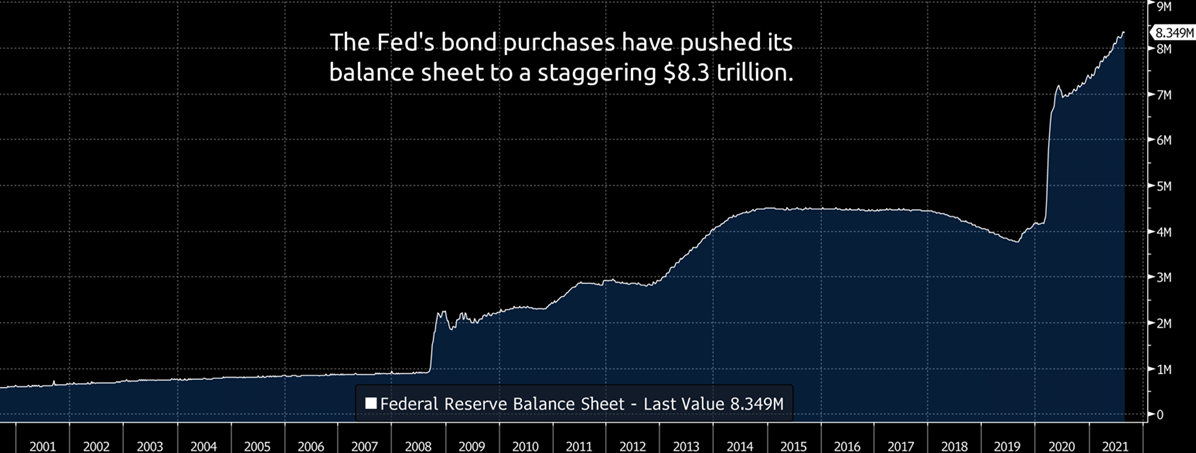

Each month, as the pandemic took hold, our nation’s central bank, the Federal Reserve (Fed), began buying $120 billion worth of bonds. The primary reasons for these purchases were to help the financial markets properly function, and to reduce long-term interest rates.

Lower long-term interest rates make business loans and mortgages less expensive.

The Fed bought bonds after cutting short-term interest rates to zero and determining that more stimulus was needed to help the economy grow. In December 2020, the Fed said it would keep buying bonds at the current pace “until substantial further progress has been made toward” its full employment and inflation goals.

The Fed’s balance sheet has ballooned again. The first time was during the Great Recession when it jumped from about $800 billion to $4.5 trillion. Because of the pandemic, it has since soared to $8.3 trillion.

The Fed has recently determined that enough progress has been made, which is why, on August 27, Chair Jerome Powell stated, “If the economy evolves broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year.”

The last time the Fed started to taper or reduce its bond purchases was in 2013. That led to the infamous “taper tantrum,” causing long-term interest rates to spike (and bond prices to fall) and the S&P 500 to drop about 6%.

Part of the reason for that volatility was that the markets were surprised. (This time around, however, the Fed has been more transparent about its plans, hoping to reduce potential market turbulence.)

Taxes

Higher taxes could be coming our way to pay for President Biden’s $3.5 trillion budget and the bipartisan $1 trillion infrastructure plan ($550 billion in new spending). What’s been telegraphed is that the corporate tax rate, top income tax rate, and capital gains tax rate for high earners could be increased. Higher taxes are often considered to not be market-friendly; however, the potential economic growth from the stimulus could offset that to some degree.

On the other hand, if this stimulus makes its way into the economy, it could fan the flames of inflation, which is yet another risk we’re keeping an eye on for you as we work to help you meet your financial goals and enjoy retirement.

September 10, 2021

All data unless otherwise noted is from Bloomberg. Past performance does not guarantee future results. Any stock market transaction can result in either profit or loss. Additionally, the commentary should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by the provided information. Market and economic conditions could change in the future, producing materially different returns. Investment strategies may be subject to various types of risk of loss including, but not limited to, market risk, credit risk, interest rate risk, inflation risk, currency risk and political risk.

This commentary has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument or to participate in any particular trading strategy or an offer of investment advisory services. Investment advisory and management services are offered only pursuant to a written Investment Advisory Agreement, which investors are urged to read and consider carefully in determining whether such agreement is suitable for their individual needs and circumstances.

Allworth Financial and its affiliates and its employees may have positions in and may affect transactions in securities and instruments mentioned in these profiles and reports. Some of the investments discussed or recommended may be unsuitable for certain investors depending on their specific investment objectives and financial position.

Allworth Financial is an SEC-registered investment advisor that provides advisory services for discretionary individually managed accounts. To request a copy of Allworth Financial’s current Form ADV Part 2, please call our Compliance department at 916-482-2196 or via email at compliance@allworthfinancial.com.